Signature Risk Partners, a Toronto-based company specializing in custom commercial insurance, has created a specialized insurance program to meet the needs of RV park and campground owners across Canada.

With rising risks and gaps in traditional policies, the company is offering a solution designed from the ground up for outdoor hospitality operators.

In an exclusive interview with Modern Campground, President and CEO James Grant emphasized that the industry’s prior lack of targeted insurance left many park owners exposed.

“There are over 3,200 parks in Canada and they were largely underserved,” Grant said. ,” Grant said. In response, Signature Risk launched Signature Park, a comprehensive program that fills the void with coverage built specifically for campgrounds and RV parks.

Unlike retrofitted commercial policies, Signature Park was designed with operators in mind. “This was written from scratch exclusively for the industry,” Grant said, noting that most existing solutions resemble “a square peg being smashed into a round hole.”

Tailored Insurance Solutions

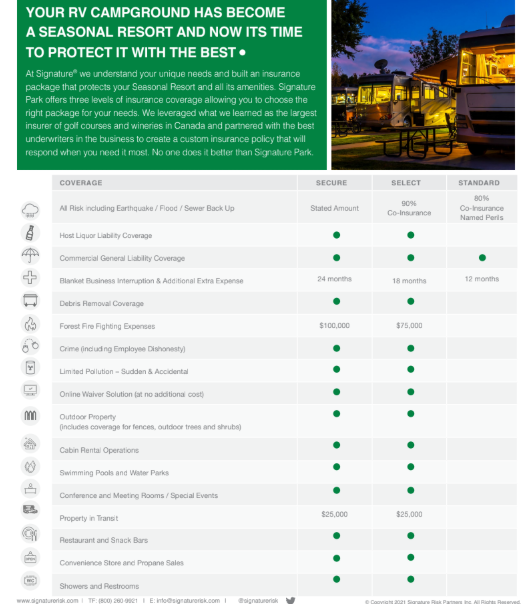

The company caters to the unique needs of seasonal resorts and has developed an insurance solution designed to protect the property and its amenities. Signature Park offers three tiers of coverage, allowing resort operators to select the package that best fits their requirements.

Signature Park covers areas that traditional insurance often overlooks, including damage to fences, signs, and utility hookups. “We provide coverage for fences, for signage—things like that that can be expensive and add up,” Grant told Modern Campground.

Business interruption protection, a critical component often absent from conventional policies, is also included. Grant noted that for remote campgrounds, if provincial or federal authorities mandate an evacuation due to a nearby wildfire, the Signature Park insurance policy is designed to respond by providing coverage to the campground owner.

When it comes to claims handling, Signature Risk also differentiates itself by assigning an independent loss adjuster rather than relying on in-house decision-makers. “The person who’s on the hook for paying the claim costs should not be the same person who decides how big the loss was,” Grant said.

The company currently partners with parks and campgrounds and continues to grow its footprint through brokers across North America.

When asked about the demographics of their clients in RV parks and campgrounds, Grant highlighted a significant shift in the industry, especially in terms of ownership trends.

According to Grant, campgrounds have been predominantly owned by couples who have operated their parks for 30 to 40 years, often as a family business passed down through generations. However, this long-standing model is changing, as many of these seasoned owners approach retirement.

Grant emphasized that for those owners who are nearing retirement or considering selling their parks in the near future, having proper insurance coverage is crucial. A significant loss at the park that isn’t covered could complicate efforts to sell the property, making insurance even more essential.

He also pointed out that the industry is transitioning away from the traditional “mom and pop” ownership model and moving towards more structured ownership groups, shaping the overall landscape of the campground sector.

AI-Powered Weather Alerts

Signature Risk Partners recently launched an AI-powered Weather Alert Tool. Released on April 22, the tool monitors Environment Canada’s weather alerts and sends real-time notifications to clients about severe weather events like storms, wildfires, and floods.

It aims to help businesses in sectors like golf clubs, wineries, and campgrounds minimize disruption and damage. Especially in the off season when a great deal of damage can occur.

The tool uses a proprietary AI agent to match weather alerts with insured clients, providing customized notifications to enable prompt action. Grant highlighted that the service enhances risk management efforts while ensuring data privacy, offering an extra layer of protection for clients who opt in.

Grant emphasized the importance of park owners and operators understanding that not all insurance coverage is the same. He advised that if park owners haven’t yet received a quote, they should consider asking their broker for an alternative. It costs nothing and could offer significant benefits in the event of a loss.

For more information about Signature Risk Partners, visit their website here.